Will the synthetics hype die off?

Lewanika Timothy | Wednesday June 26, 2024 13:24

During the recently ended Future of Mining summit, one common thread ran across the speeches of executives: the fear of synthetics. If synthetics aren’t all that, then why is everyone talking about them?

Speaking economically, diamonds economically are part of a segment of goods called Veblen. Their prices positively increase with their demand and companies like De Beers have thrived and excelled due to the ability to convince the market that there is such a limited number of diamonds in the world that each one is worth tussling for, sold to the highest bidder.

With synthetics now in the picture, the question is how special are diamonds?

This could go two ways: if the market perceives that there is no distinction between buying a natural diamond and buying a synthetic, then its doomsday for the naturals. This would mean that the rarity sales pitch would lose power over consumers and prices will plummet drastically.

The second outcome could be that synthetics could further segment the market, making rough diamonds scarcer in a world saturated by synthetics and this would spur natural diamond prices. Economists and market experts have been divided between these two schools of thought, but what do the numbers say.

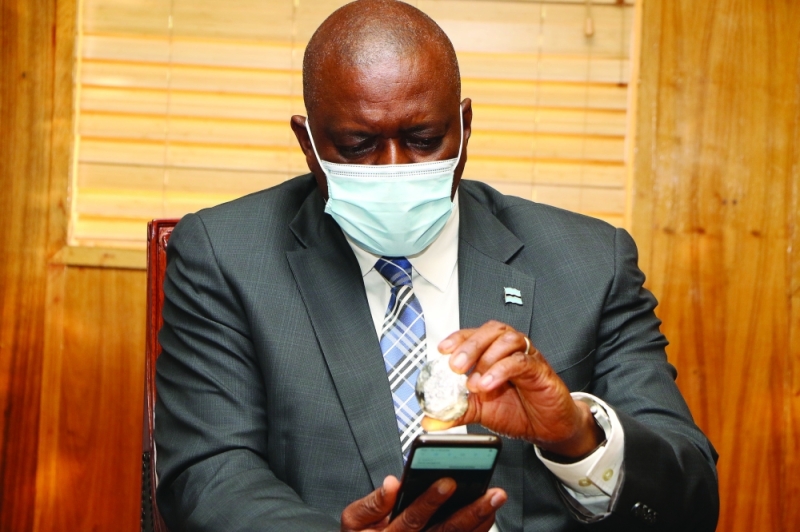

Speaking recently during an interview, Minister of Minerals and Energy Lefoko Moagi said that the synthetic diamond market was headed for collapse as sales and margins enjoyed by players in the industry have been shrinking year on year.

“Figures don’t lie,” he said.

“Continually the prices are falling.

“If you look at January to April in 2021, the gross profit for lab grown was 220%, following year was 68%, in 2023 it was 34%, 2024 it is at 11%. There is a continuous decline.

“That is where we will anchor our natural diamond story to strengthen our proposition.”

According to Moagi, the diamond market will further segment to support the recovery of rough diamonds.

“There will always be differentiation. We are going to continue using rarity to build sentiment. “We believe there is a distinct differentiation and the market share is different.

“We can see where synthetics are going, just downward,” he said.

According to Moagi, Botswana will pursue other actions to reinforce its position as a rough diamond producer, one of them being heavy investment in technologies that can differentiate between synthetics and rough diamonds.

The global synthetic diamond market size was valued at $19.5 billion in 2023 and is projected to reach $28.66 billion by 2031, growing at a compounded annual rate of 5.01% from 2024 to 2031.

The synthetic diamond market has witnessed robust growth in recent years, driven by technological advancements, increasing consumer awareness, and rising demand for sustainable and ethically sourced diamonds. Synthetic diamonds, also known as lab-grown or cultured diamonds, are manufactured in controlled laboratory environments using advanced techniques such as Chemical Vapour Deposition (CVD) and High-Pressure High-Temperature (HPHT) methods.

In 2020, demand for diamonds slumped due to COVID-19 but in 2021 and 2022, sales rose, helping bolster prices and production for countries such as Botswana.

Throughout that period, lab growns were bubbling underneath, offering a fraction of the price of the naturals and the claim that they are more ethically and sustainably produced. Russia’s invasion of Ukraine in February 2022 and the global effort to block Moscow’s stones from selling in the world market, gave synthetics a much needed and major marketing boost.

Presenting De Beers’ financial results recently, De Beers Vice President for Diamond Trading, Paul Rowley, conceded that synthetics were causing the natural diamond giant a headache.

The veteran diamond executive also made a curious statement, noting that the price collapse of synthetics has taken longer, consequently creating competition between rough stones and synthetics.

“Synthetics have surely taken longer for prices to fall but we expect their prices to continue dropping in upcoming cycles thereby further creating segmentation from rough diamonds,” he said.

The segmentation of the two, or “bifurcation” as the industry calls it, is expected to occur when lab growns are clearly assigned their own corner of the market with their own prices and niche clientele, while naturals enjoy their premium rating, pricing and prestige.

Rowley’s comments about falling prices refers to the collapse in lab grown prices in recent years, as factories creating them have mushroomed in China and India, with improved technology and higher unit sales

“Despite the slump in sales affected by varying factors, you can still see the resilience of natural diamonds.

Lab-grown has risen in popularity in recent years, representing an increasing share of retail jewellers’ diamond sales.

Synthetics account for a mid-teen percentage of the diamond mix at Signet Jewellers, the largest specialty jeweller in the US, CEO Gina Drosos reported in a recent earnings conference call. Lab-growns made up half of loose diamonds and about 6.5% of set diamond jewellery sold by specialty jewellers in the US during July, according to Edahn Golan, cofounder of Tenoris, a trend analytics company.

.

Consumers with a budget in mind are trading up to increased size or quality lab-grown diamonds, presenting the jeweller with a higher margin and transaction value than natural diamonds on average, Drosos explained.

Global industry veteran, Martin Rapaport who runs the world’s largest diamond trading network, recently published a report which predicted the decline of the real diamond market due to synthetics especially in low carat diamonds.

The biggest gain for synthetics over the past year has been in the bridal and engagement market. However, Rapaport in his report predicted that lab-growns would lose the bridal segment as their value continues to decline. Rather, he anticipated that synthetics would take over the big fashion-jewellery business.

For now, though, bridal is under attack by synthetics, which may have a lasting effect on consumer attitudes, Rapaport noted. By pushing the product, jewellers are convincing millennials and Gen-Z consumers to spend less on engagement rings — and that real diamonds are not important, he cautioned.

“That’s a crime. What business does that?” he stressed.

“We’ll see a backlash, because women want to get married and the whole exclusive relationship scenario talks to natural diamonds. If a customer feels it is worth paying more, and give something meaningful, the best they can do is buy the real thing.”

Rapaport acknowledged that the price differential is currently working in favor of synthetics. He compared the cost and selling price of a 2-carat, F-color, VVS2-clarity natural diamond with the equivalent synthetic stone at various stages of the distribution chain (see table). The profit margin earned by jewelers was 24% for the natural diamond versus 83% for the synthetic stone. Furthermore, the difference in retail price represented a saving to the consumer of $31,104, Rapaport’s research showed.

Meanwhile, Golan this week said despite synthetics swimming in troubled waters, the industry will consolidate and increase its bargaining ability over rough diamonds

“The downward price trajectory means that lab growns are about to see a series of market consolidations. The remaining stand-alone growers will have to partner with manufacturers and getting equity will be involved.

“If not, they’ll need to find financing until they reach their holy grail – tech applications,” he said.

He however continued with a grim projection: “Some US retailers will reduce their lab grown offerings to the bare minimum, which means that goods will only be held on memo.

“They are already advising their customers that lab growns, unlike natural diamonds, are not accepted back for trade-ins'.