GABS challenges impact gov't fiscus, SME's stability

Lewanika Timothy | Tuesday August 20, 2024 10:26

However, persistent issues with the system mean that government lacks information on its spending and revenue, resulting in blind planning and budget implementation. The situation poses a serious risk to the economy.

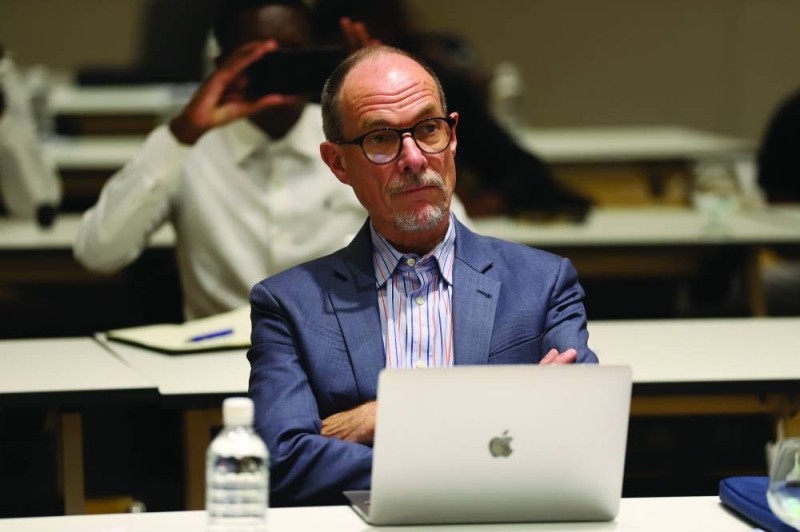

Economist and former Deputy Governor at Bank of Botswana, Keith Jefferis, speaking at the Botswana Insurance Fund Management (BIFM) annual economic update meeting, said that the collapse of GABS has left government running the economy without actual knowledge of revenue levels and incurred costs, complicating economic management.

“Revenue appears to be significantly below budget figures, but GABS collapse obscures the true picture. “Even the final 2022–2023 figures are still not available,” Jefferis said.

In November last year, Minister of Finance Peggy Serame told Parliament that statistics showed that GABS had been significantly dysfunctional for extended periods, leading to serious performance challenges. The problem stemmed largely from an excessively slow system, to the point of failing to process normal operational requests.

The collapse of GABS additionally means that suppliers who do business with government cannot receive their payments on time. Given government's role as the leading micro-economic player, failure to pay suppliers on time often has far-reaching implications on the economy and company cash flows, which may in turn lead to business closures and job losses if not promptly addressed.

Jefferis further added that the collapse of GABS is part of the reason Botswana’s economy has stagnated, with zero percent growth recorded up to March 2024. This stagnation, he said, is due to the private sector not receiving payments from government, resulting in subdued economic activity.

He also warned that the true state of the national fiscus could be much worse than it appears, as the failure of GABS prevents the accurate assessment of government finances.

Last week in Parliament, Serame said GABS was afflicted by “short and medium term” issues, but insisted that payment of suppliers was not as severely impacted as many commentators have said. The minister also cautioned Batswana against the speculation that GABS’ troubles are being used to hide government’s cash flow troubles.

According to Serame, in June alone, 88,000 suppliers were paid which would not have happened if “the money was not available”.